Roi formula property

Value of 9 Debentures is 90000. The value per share of PQR Ltd is 700.

Quick Flip Quick Tip Calculating Roi Net Profits In Real Estate Youtube

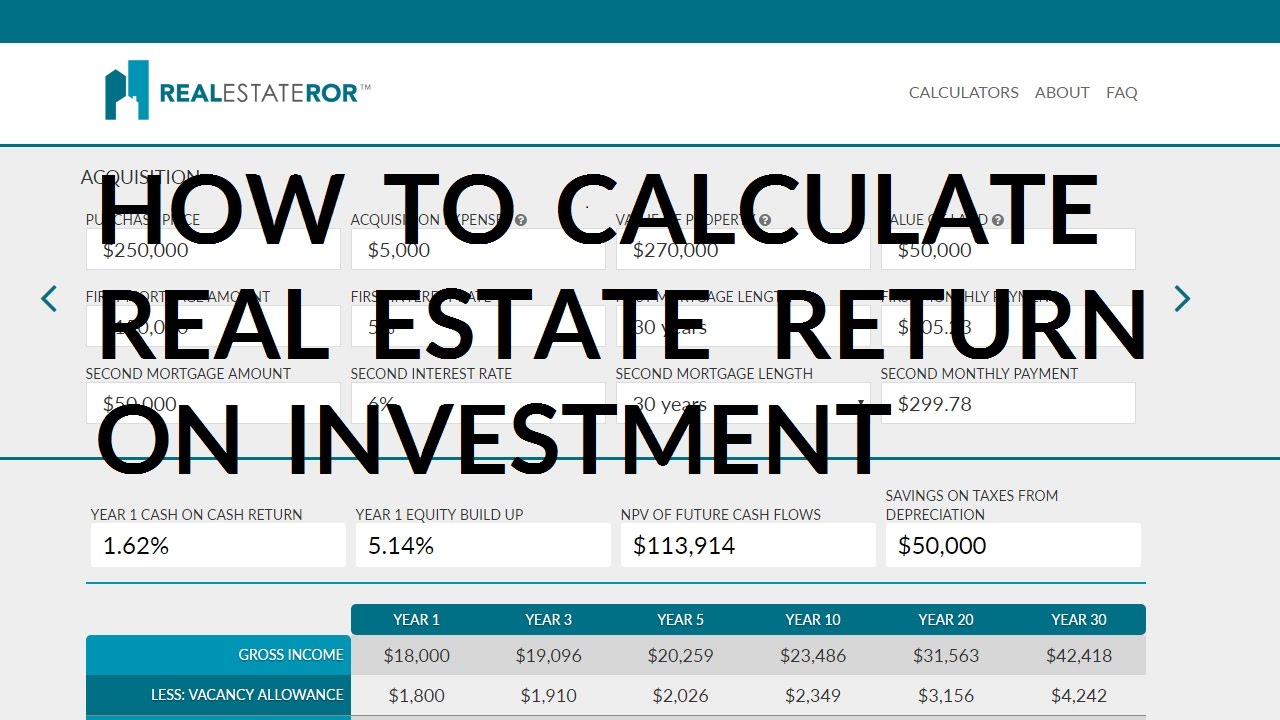

The formula does not take into account any appreciation or depreciation.

. Yes investing in rental real estate income property could be the best investment of the next 10 years. Our industry-leading speech-to-text algorithms will convert audio video files to text in minutes. As a concept it can measure profitability or efficiency.

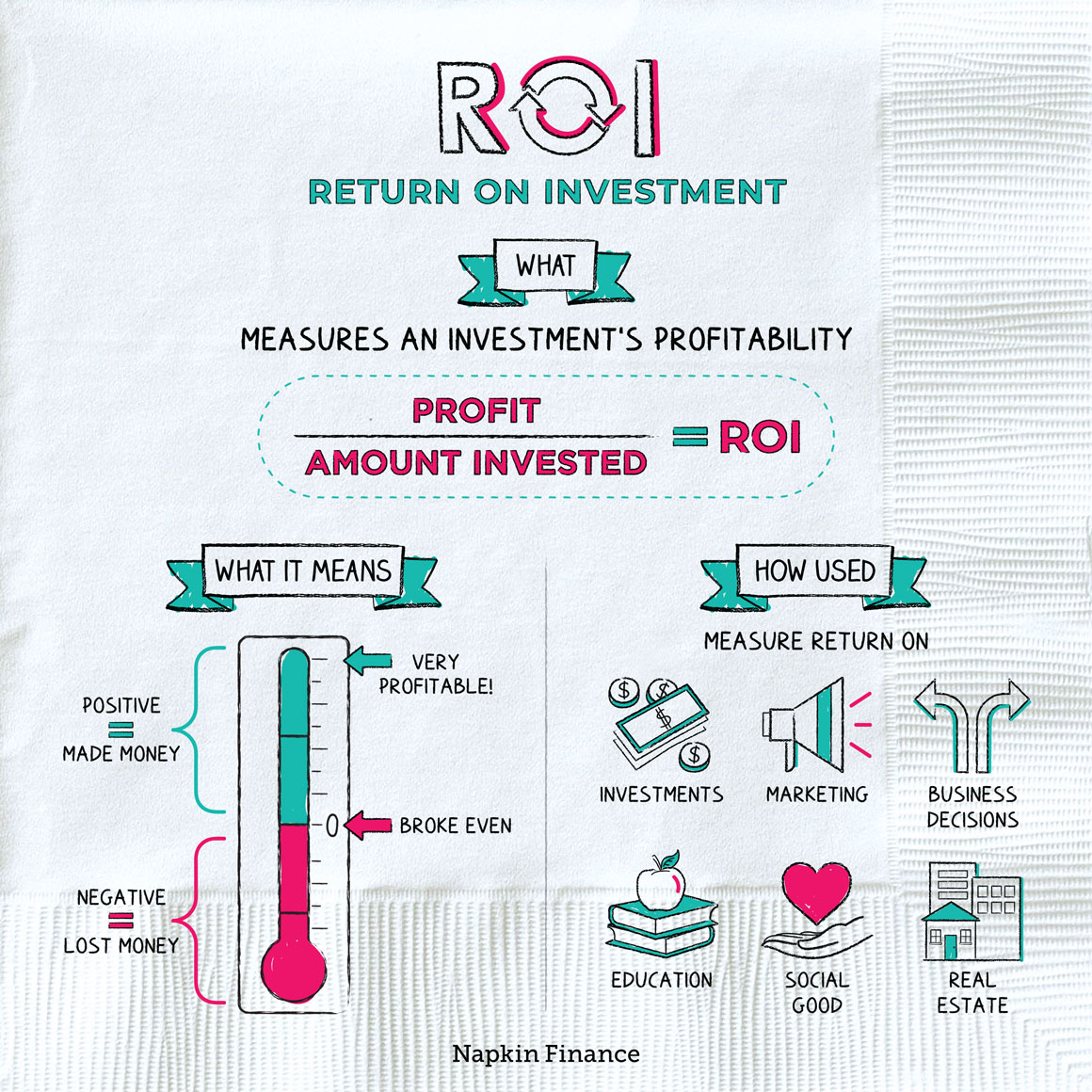

Input just three numbers. A high ROI means the investments gains compare favourably to its cost. ROI Net Profit Total Investment 100.

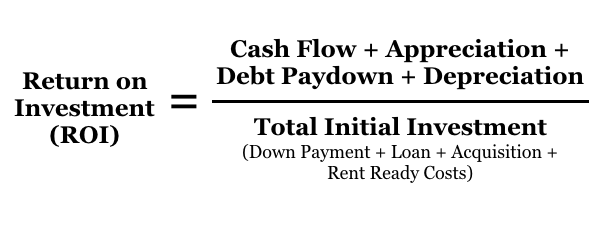

Thats pretty good over the long term. LibriVox is a hope an experiment and a question. You paid 100000 in cash for the rental property.

For example if sales dropped 1000 a month on average for the previous 12-month period and a 500 marketing campaign results in a sales drop of only 200 that month then your calculation. Latest-news Thailands most updated English news website thai news thailand news Bangkok thailand aecnewspaper english breaking news. Rental properties are known to yield anywhere from five to 10 percent with some investments even going.

A marketing manager can use the property calculation explained in the example section without accounting for additional costs such as maintenance costs property taxes sales fees stamp duties and legal costs. Expected price repair cost and the monthly rent. The ROI Calculator shows you the total gain on investment.

How to calculate ROI Return on Investment Calculating annualized return. Calculating a propertys ROI is fairly straightforward if you buy a property with cash. Total Return Formula Example 2.

Calculate yield ROI profit required investment stamp duty available mortgage and more. An ROI calculation will differ between two people depending on what ROI formula is used in the calculation. ROI is relatively easy to calculate using the following formula.

So say you invested 50000 in the investment property and the total profits you made from your investment sum up to. But real estate is. A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments.

This yields a value of 185. What one investor considers. With the value of the property at 200000 your equity position or potential profit is 130000.

ROI measures the amount of. Rate of Return on a Rental Property Calculation. The formula is simple.

Buy-to-let Property Profit and Tax Calculator. ROI Annual Returns Cost of Investment. Unlike during the bubble years income property bought at the right price can now generate positive monthly cash flows for the investor.

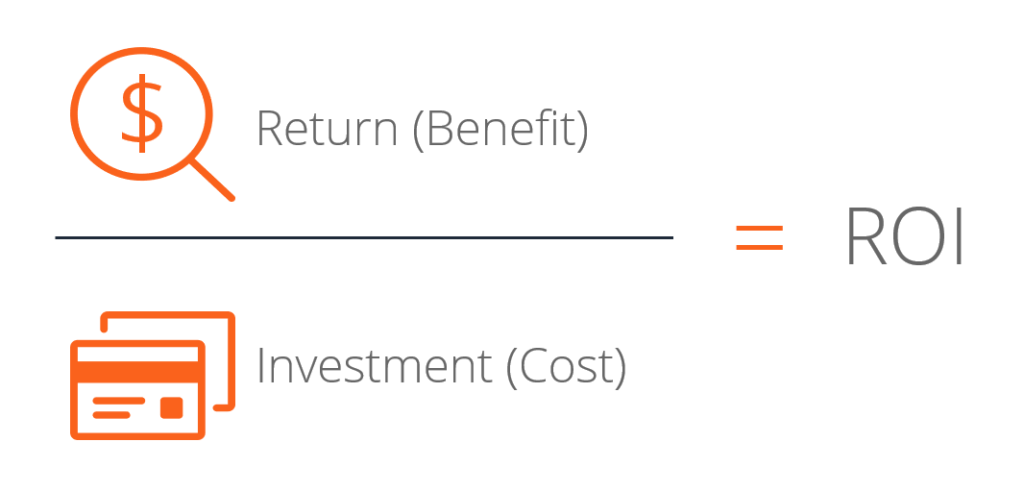

To calculate return on investment you should use the ROI formula. People refer to ROI when discussing what they get back for their input. You purchase a property in New York for 600000.

The equation that allows calculating ROI is as follows. Return on investment is a ratio that evaluates how efficient a certain investment isIt is the obligatory starting and finishing point for any ambitious investor as it presents the potential of a future deal and the end results of a finished one in simple numbers. Try our remortgage profit calculator.

ROI Gain from Investment Cost of InvestmentCost of Investment. It does not account for other risks associated with the underlying property. Our newly calculated percentage for ROI Return cell D60 will divide the Yearly Cash Flow cell D58 by the Invested Equity cell D59.

The formula for NPV doesnt distinguish a projects size or give favorability for higher ROI. Take the generated income and subtract the total operating costs. The ROI formula is based on two pieces of information - the gain from investment and the cost of investment.

Option A might require an initial investment of 1 million while Option B may require an initial. It is essentially a simple interest calculation. Can the net harness a bunch of volunteers to help bring books in the public domain to life through podcasting.

By now real estate investors should know the simple rate of return formula which is. However ROI is a true metric that can be calculated as a ratio or percentage. Three years later you sell this property for 900000.

Sonix is the best audio and video transcription software online. ROI formula for rental property. The ROI Calculator consists of a formula box where you enter the initial amount invested the amount returned and the investment period.

ROI is used as a concept and a specific formula. Heres an example of a rental property purchased with cash. Using the latest stamp duty rates.

52219100000 100 5222. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. For instance for a potential real estate property investor A might calculate the ROI involving capital expenditure taxes and insurance while investor.

To calculate your return on investment you essentially need to divide the amount of money youve earned from the investmentcommonly known as your net profitby the cost of the. Then identify the final value of the investment which includes the 360000 that you receive from selling the home less any commissions taxes or fees you paid to sell the. When some cash is a return of capital ROC it will falsely indicate a higher return because ROC is not income.

ROI - Practical Examples ROI Formula. Sonix transcribes podcasts interviews speeches and much more for creative people worldwide. This means that for every dollar we invest we are receiving an additional 185.

While the ROI formula itself may be simple the real problem comes from people not understanding how to arrive at the correct definition for cost andor gain or the variability involved. Return on investment ROI or return on costs ROC is a ratio between net income over a period and investment costs resulting from an investment of some resources at a point in time. Already own the property.

The basic formula to calculate ROI is. One ROI formula is ROI Net return on investment Cost of investment x 100. Now for calculation of Total Return and of Total Return the following steps are to be taken.

Return On Investment - ROI. As a performance measure ROI is used to evaluate the efficiency of an investment or to compare the efficiencies. For example if an investment generates annual returns of 5000 and the cost of the investment is.

At the time of purchase the property value of your home was appreciated at 300000. The Formula for Calculating ROI Given our previous points the next step will be using the real estate ROI formula in practice and seeing how it is calculated. To calculate the ROI of a property take the estimated annual rate of return divide it by the property price and then convert it into a percentage.

What Is a Good Return on Investment ROI for Real Estate Investors.

How To Calculate Roi On Rental Property Rapid Property Connect

Roi Formula Calculate Roi And More From Napkin Finance

5 Easy Ways To Measure The Roi Of Training

Calculating Returns For A Rental Property Xelplus Leila Gharani

How To Calculate Roi On Rental Property Rapid Property Connect

How To Calculate Roi For A Potential Real Estate Investment Excelsior Capital

How To Calculate Roi On Spanish Rental Property Buyer S Agent Spain

Roi In Real Estate How To Calculate Roi On Property 99acres

What Is A Good Return On Investment For Rental Properties Mashvisor

How To Increase Roi On A Rental Property Mashvisor

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

How Do You Calculate Return On Investment On Rental Property

How To Calculate Roi On Spanish Rental Property

Calculating Returns For A Rental Property Xelplus Leila Gharani

4 Ways Passive Investors Can Calculate Roi In Real Estate

4 Ways Passive Investors Can Calculate Roi In Real Estate

Return On Equity Denver Investment Real Estate